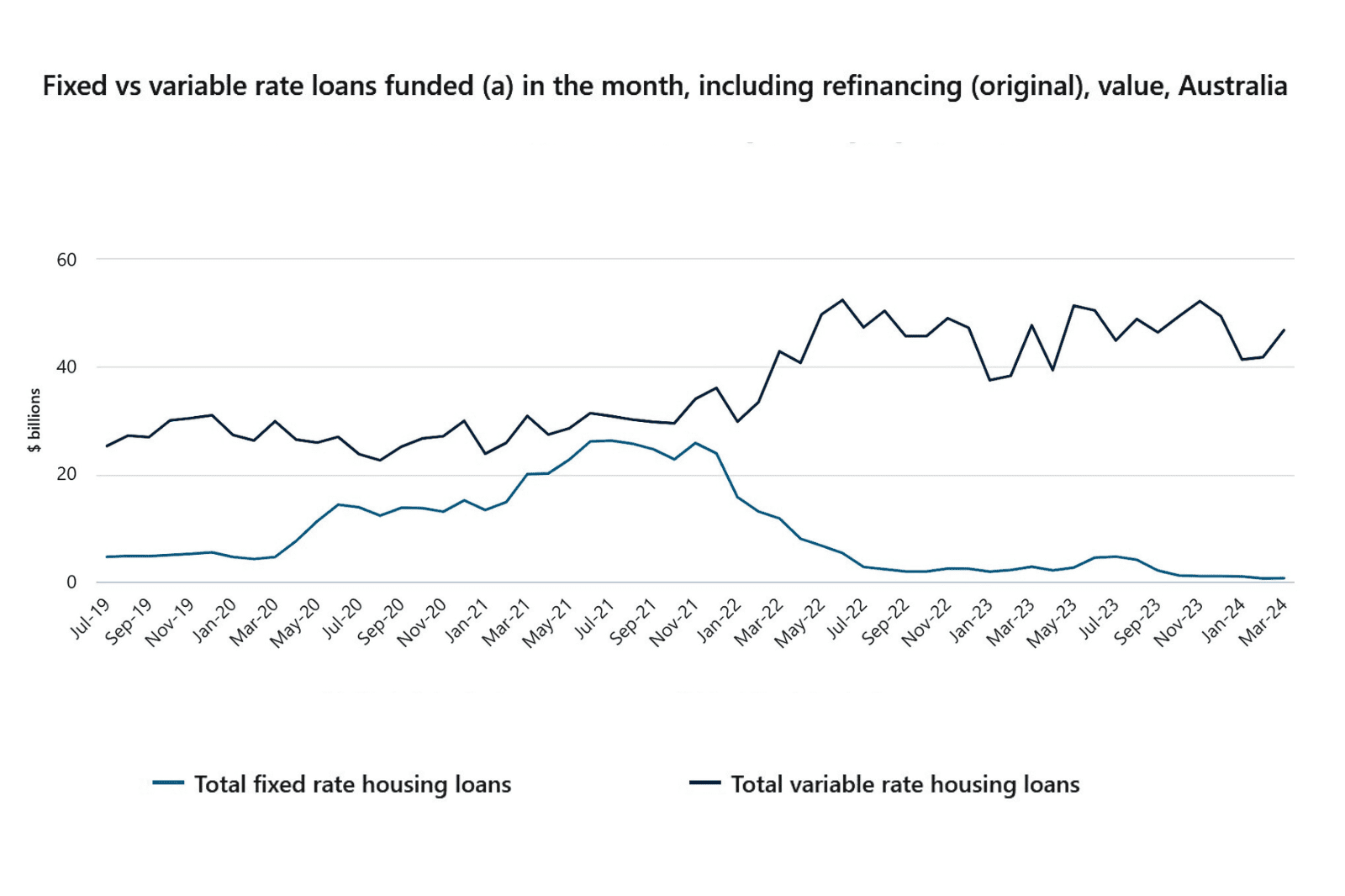

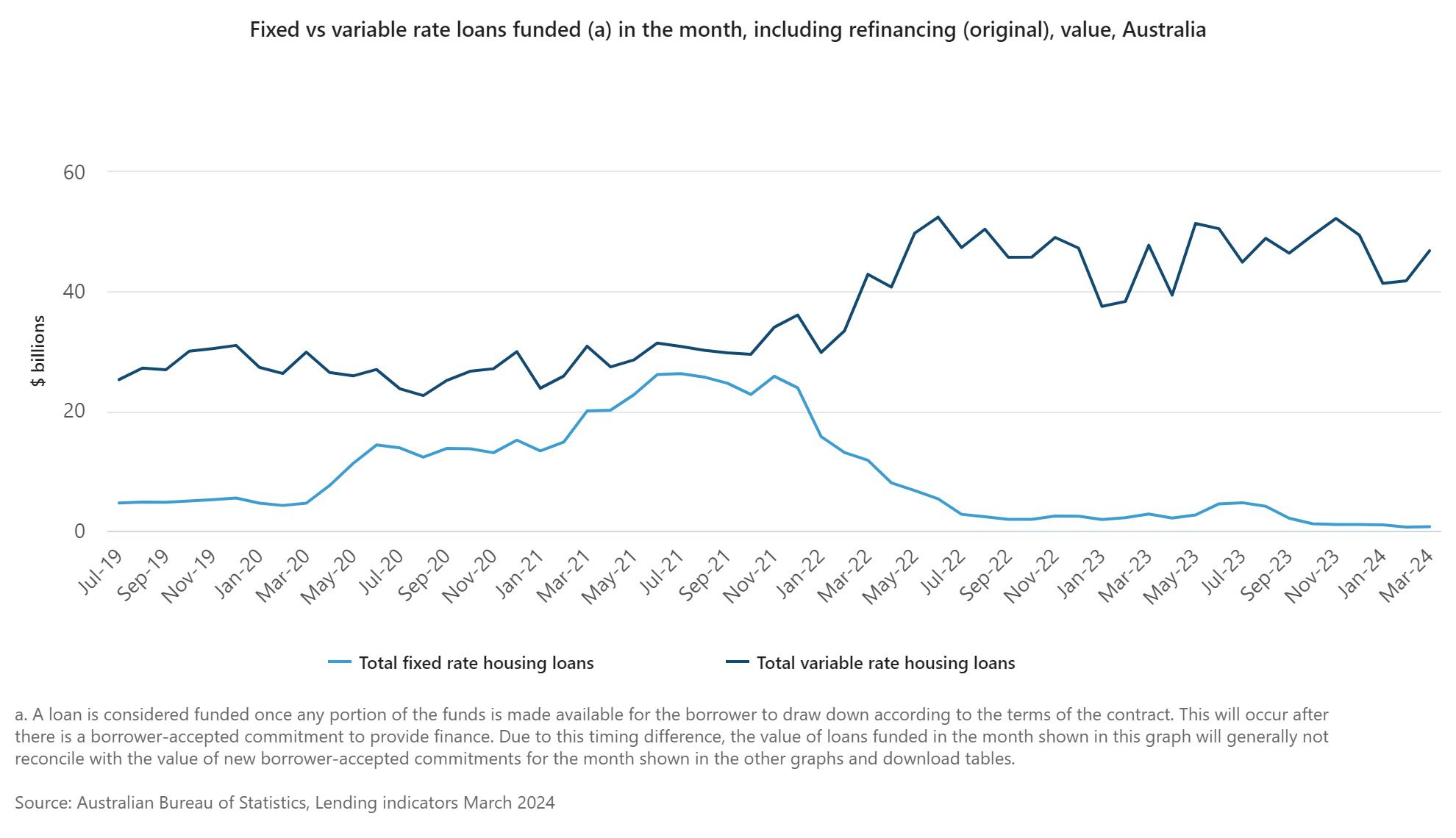

The graphic released by the Australian Bureau of Statistics highlights how the property purchasing experience for millions of homeowners has been like a rollercoaster.

The graphic released by the Australian Bureau of Statistics highlights how the property purchasing experience for millions of homeowners has been like a rollercoaster.

At the start of the pandemic, in March 2020, ABS figures showed 13.38% of new were borrowers choosing fixed-rate loans while 86.62% were on variable deals.

In the middle of the pandemic, in July 2021, when interest rates were at record-low levels, the number of those on fixed rate mortgages was at an unprecedented 46.02% while 53.98% were on variable rates.

Latest figures from the ABS show just 1.40% of borrowers had fixed deals in March while those on variable rates stands at 98.6%.

But what’s the story behind the picture.

The fact that so many people are sitting on variable rates is because they are waiting – and hoping – the RBA will soon bring the base rate down, Equilibria Managing Director Anthony Landahl says.

“People are hoping that rates have peaked and are saying ‘why am I going to fix if they are coming down’,” he said.

But like so many involved in the property-buying chain, Anthony is cautious about what is around the corner.

“While we are not seeing a lot of people fixing or talking about fixing that might change,” he said.

“There has been a lot of talk about getting on top of inflation, but it’s proving sticky. And with a potentially inflationary budget there is a very real possibility the RBA will be thinking about a rate rise when the Board meets next week.”

Anthony described the 2020 statistics as phenomenal, but not surprising given the record lows interest rates were sitting at during those “extraordinary times”.

“They couldn’t really go any lower, so it made sense to take out fixed rate loans.”

As for those who are currently ‘doing it tough’ on bigger variable repayments, he said: “They are adjusting to paying more, waiting for the rates to be cut.”

For Nick Clunes, director at The Lending Lab, it is a similar scenario.

The general sentiment is that people can pay extra and are waiting for rates to come down rather than fixing, he said.

But he said the RBA would be conscious of the additional impact on those borrowers who are now on potentially paying much larger repayments following the 13 successive rate hikes in 15 months as ‘people are really feeling the effects’.

Commenting on the unprecedented figures from the height of then pandemic, he said: “Something that’s missing in the ABS charts is the consumer sentiment.

“When we were writing large loans, people were risk averse and taking advantage of the low fixed rates.”